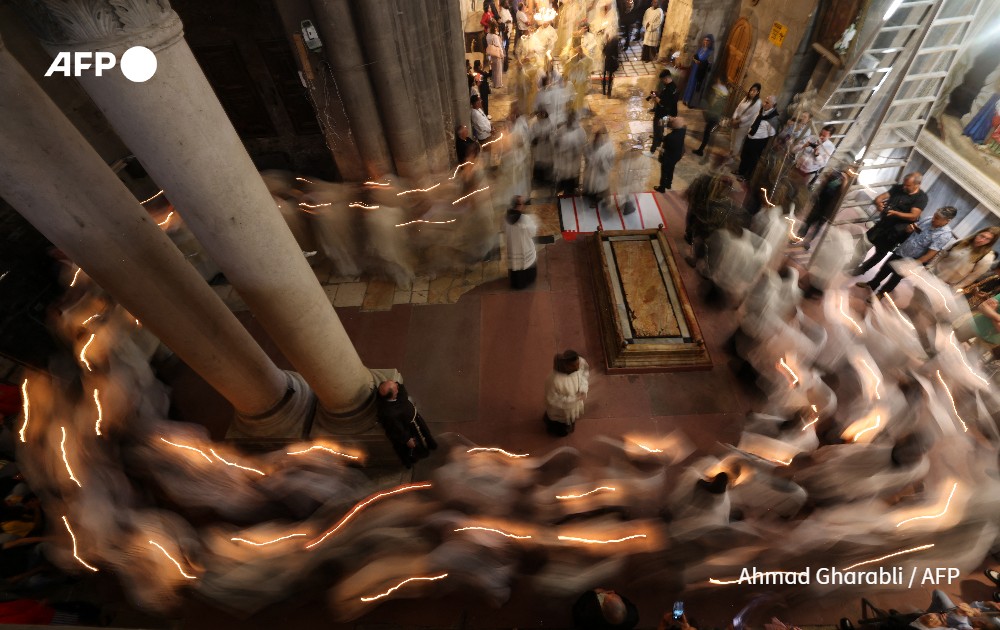

Topshots of the Week (6 - 12 April)

A selection of some of the most striking photographs taken by AFP photojournalists from 6th April to 12th April 2024.

Beirut (AFP) | 26/01/2026 - 16:21:32 | Hezbollah chief says any attack on Iran also targets group

Geneva (AFP) | 26/01/2026 - 16:07:43 | UN fears hundreds of migrants missing or dead in Med shipwrecks since start of 2026

Toronto (AFP) | 26/01/2026 - 16:02:13 | Carney says latest Trump tariff threat a tactic ahead of trade deal review

Washington (AFP) | 26/01/2026 - 15:47:32 | Trump sending border czar to Minnesota after latest killing

Brussels (AFP) | 26/01/2026 - 15:32:56 | EU says WhatsApp to face stricter content rules

Gaza City (AFP) | 26/01/2026 - 15:27:12 | Hamas says return of last Gaza hostage shows its 'commitment' to ceasefire

Jerusalem (AFP) | 26/01/2026 - 15:22:47 | Netanyahu says Israel 'brought them all back' after last Gaza hostage returned

Jerusalem (AFP) | 26/01/2026 - 15:13:41 | Netanyahu says Israel 'brought them all back' after last Gaza hostage returned

Warsaw (AFP) | 26/01/2026 - 15:12:56 | Saudi Arabia wants 'strong, positive' relationship with UAE after Yemen row: FM

Dubai (AFP) | 26/01/2026 - 15:09:30 | UAE won't allow attacks on Iran from its soil: foreign ministry

A selection of some of the most striking photographs taken by AFP photojournalists from 6th April to 12th April 2024.

Hanshow, a global leader in digital retail solutions, announced that its All-Star digital solution has earned SOC 2 Type II and SOC 3 certifications following an independent audit by Deloitte. These internationally recognized certifications underscore Hanshow’s commitment to robust data security, privacy protection, and operational reliability for retailers worldwide. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251201803690/en/All...

Cinemo, a globally recognized one-stop-shop provider of fully integrated digital media products, today introduced the Cinemo Cloud Ecosystem to help audio device manufacturers, streaming content providers, and users unlock a new era of digital media experiences. Software-defined audio provides a paradigm shift in the audio market and expands what devices can do by providing a growing range of features, content options, and app functions. The Cinemo Cloud Ecosystem leads the way with a secure a...

Just a few months after the world’s first Gastric Mucosal Ablation (GMA) case using MOVIVA® at the Policlinico Universitario Agostino Gemelli in Rome, clinical experience is rapidly expanding across Europe. With around 80 procedures performed within a short timeframe in eight countries, MOVIVA® is helping to establish a new era of endoscopic bariatric treatment – offering a less invasive option as obesity rates continue to rise worldwide. This press release features multimedia. View the full re...

A selection of some of the most striking photographs taken by AFP photojournalists from 30th March to 5th April 2024.

A selection of some of the most striking photographs taken by AFP photojournalists from 23rd to 29th March 2024.

A selection of some of the most striking photographs taken by AFP photojournalists from 16th to 22nd March 2024.

A selection of some of the most striking photographs taken by AFP photojournalists from 9th to 15th March 2024.

Muslim devotees offer night prayers marking the start of Islam's holy fasting month of Ramadan at Istiqlal mosque in Jakarta on March 11, 2024.

© Adek BERRY / AFP